Seoul apartment prices fall steepest in 10 years

No rebound in sight for loal housing market

The real estate market entered a deep slump following the global economic crisis in 2008 and still shows no sign of an imminent rebound.

Homeowners, who borrowed money to buy houses during the property boom period from 2005 through 2007, are experiencing severe financial pain because they have to make interest payments month after month while the price of their property plunges. Even if they want to dispose of the unit to pay back their mortgage, they are unable to do so because nobody is looking to buy.

Analysts here say that it is unlikely that the domestic real estate market will bounce back in the foreseeable future. Compounded by the European sovereign debt crisis and other unfavorable economic conditions at home and abroad, people continue to refrain from purchasing apartments and other residential properties in anticipation of a further decline.

In a bid to turn the market around, the government has introduced a series of measures over the past few years, but to no avail. Home prices fell even despite state pump-priming steps as people regard them as a signal indicating bigger market drops.

Reflecting this prolonged slump, apartment prices in Seoul recorded the steepest fall in 10 years, according to Doctor Apt., one of the country’s online real estate information providers.

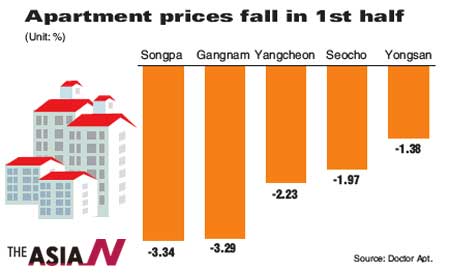

Doctor Apt. said apartment prices in the capital city fell 2.14 percent in the first six months of this year from the same period last year. Of 25 districts, 24 saw apartment prices head downward, with only Eunpyeong district, northern Seoul, posting a climb.

In particular, Songpa district and Gangnam district, both in southern Seoul, a barometer of Korea’s real estate sector, posted steeper declines. In those districts, apartment prices fell an average 3.34 percent and 3.29 percent, respectively.

A growing number of owners of high-priced apartments, south of the Han River, have sought to sell their units to move into smaller, lower-priced ones and use a portion of their capital gains to buy shops and other commercial properties to generate cash flow.

However, prospective buyers are not interested in owning expensive units, exerting further downward pressure on them.

As a whole, apartment prices across the country fell by an average of 1.13 percent in the first half, with those located in Seoul, Incheon and Gyeonggi Province recording a steeper downward rate of 1.62 percent.

“There seems to be no cure for the real estate sector at the moment,’’ said Cho Eun-ang, senior manager of content database team at Doctor Apt. “In the past, property values used to head upward before and after elections as candidates unveil a range of market-boosting measures. But this was not the case for the April 11 general elections. It will not be much different for the December presidential election either.’’

Cho said the European debt crisis and other negatives have dampened the value of apartments in southern Seoul. “Gangnam acts as a barometer for the country’s entire housing sector. Unless apartments there pick up in value, units in the rest of Korea will remain depressed.’’

The manager then said most prospective buyers take a wait-and-see attitude, expecting prices to go down more. “The biggest problem is that people have lost faith in the real estate market. Even if the government removes the debt-to-income ratio and other regulations, it won’t make much difference.’’ <The Korea Times/Lee Hyo-sik>