Free fall slide

LG Chem, Kumho Petro tumble in stock market

LG Chem, Kumho Petro tumble in stock market

The local stock market has been highly volatile over the past few weeks amid lingering woes over the eurozone’s debt crisis and a slow recovery by major economies, including the United States.

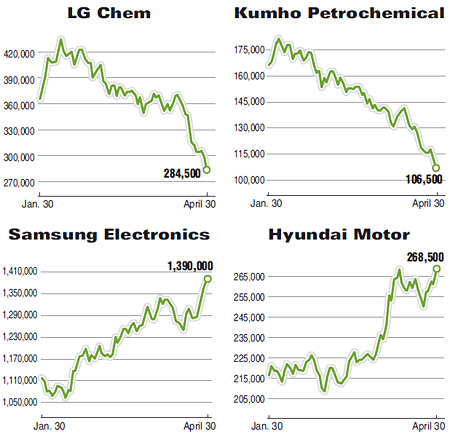

In this unstable market, domestic companies have shown quite contrasting movements based on their earnings results and external factors. Chemical firms have suffered a major setback in the stock market while electronics and auto manufacturers have enjoyed strong rallies.

LG Chem and Kumho Petrochemical have continued to see a freefall in their share prices, due to first quarter earnings shock coupled with growing fears over China’s hard landing. Local chemical firms rely heavily on the Chinese market.

But Samsung Electronics and Hyundai Motor have been leading the rally, pushing up the benchmark Korea Composite Stock Price Index (KOSPI) to 2,000, as their major market, the United States, has shown signs of recovery from a long recession.

Analysts say that the sharp distinctive performances by several leading firms will continue for a while due to the influence of influential outside markets.

“Overall, chemical firms such as LG Chem and Kumho Petrochemical have showed very disappointing performances in the stock market,” Kim Byung-yeon, analyst at Woori Securities, said. “They are in earnings shock now, and figures in their major market, China, which are not so rosy at the moment, have also affected them.”

The share price of LG Chem, a leading manufacturer of rechargeable batteries, soared to 434,000 won per share on Feb. 9, the highest level this year, and has since plunged to close at 284,500 won on Monday, 4.53 percent down from Friday. The stock market did not open Tuesday as it was Labor Day.

The stocks of Kumho Petrochemical and Honam Petrochemical have also moved in a similar pattern. Kumho increased to 185,500 won on Feb. 6, its highest prices this year, and has since dropped to close at 106,500 won on Monday. Honam also hit a record high of 398,000 per share on Feb. 6 and has since continued to plunge. It closed at 272,000 won on Monday.

Shares of banks, shipbuilders and steelmakers are also struggling with the eurozone crisis, which will put them on a roller coaster ride for a while, Kim said.

Samsung Electronics’ stock hit 1.05 million won on Feb. 3, the lowest level in the past six months but reached a record high of 1.4 million won on April 30. It closed Monday at 1.39 million won.

The nation’s top automaker Hyundai Motor also hit bottom for this year at 205,000 won on Feb. 28 but has since reached a record high of 269,500 won on April 9. It closed at 268,500 won on Monday.

Their performances are in line with record earnings.

Samsung Electronics saw its first-quarter earnings hit an all-time high thanks to brisk global sales of smartphones, posting sales of 45.3 trillion won in the first quarter of 2012, up 22.4 percent from about 37 trillion won a year ago, while its net profit was 5 trillion won, up 81 percent from 2.8 trillion won.

Shares of Hyundai Motor and affiliate Kia Motors have also been on the rise since last month on robust overseas sales in the first quarter, pushing up shares of automotive parts makers and other related companies. Last week, Hyundai and Kia announced that their global sales volume last month rose 17.9 percent from a year ago to 382,659 vehicles, and 7.1 percent to 240,457 cars respectively, despite sluggish domestic sales.

“Samsung Electronics, Hyundai Motor and Kia Motors are the most promising stocks at the moment,” Lim Soo-gyun, an analyst at Samsung Securities, said. “The prospect for semiconductor markets is bright, which can help increase the stock prices of Samsung Electronics, and Hyundai Motor and Kia Motors are expected to post bigger earnings in the latter quarters given the fact that the first quarter is traditionally a slow season for automakers.” <Korea Times/Kim Tae-jong>