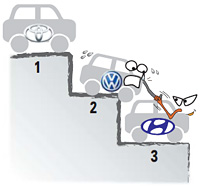

Hyundai set to beat Volkswagen in market cap

As far as market share is concerned, Hyundai Motor Group is the world’s No. 5 player. But when it comes to market capitalization, it is closing the gap on the runner-up spot.

As far as market share is concerned, Hyundai Motor Group is the world’s No. 5 player. But when it comes to market capitalization, it is closing the gap on the runner-up spot.

As of the end of Tuesday, the combined market capitalization of Hyundai Motor Group’s top two brands ― Hyundai Motor and Kia Motors ― amounted to $78.8 billion, placing it third.

Toyota was the runaway leader at $135.6 billion followed by Volkswagen with $80.7 billion. Nissan was fourth at $43.9 billion and then Ford with $40.6 billion.

“Late last year, Volkswagen maintained a comfortable lead against Hyundai as the former’s market value was bigger than the latter by more than $10 billion,’’ a Seoul analyst said.

“But the gap has contracted to around $2 billion during the past four months. Now, Volkswagen seems to be in range of Hyundai in the competition for second place.’’

Korea Investment & Securities researcher Suh Sung-moon said that Hyundai Motor Group is outpacing Volkswagen in growth potential and operating profit.

“Both Volkswagen and Hyundai Motor Group are faring well on the international scene despite economic troubles but we see Hyundai’s potential and profitability as better,’’ Suh said.

“If Hyundai Motor and Kia Motors further record fast growth on the Seoul bourse, they might nudge past Volkswagen earlier than expected.’’

Although Volkswagen has dominated the fastest-growing Chinese market, Suh said that Hyundai Motor Group has strength in other developing countries on top of established one like the United States.

He added that Hyundai’s portfolio of selling about 70 percent of its products in fast-expanding developing economies and the resulting handsome profitability will be ammunition to catapult the firm past Volkswagen.

During the first quarter of this year, Hyundai and Kia chalked up operating profit ratios of 11.3 percent and 9.5 percent respectively for a weighted average of 10.6 percent.

Korea’s foremost carmaker was the only one in the world to rack up a double-digit operating profit ratio among those producing more than 5 million vehicles last year.

The outstanding bottom lines are attributable to increasing price tags by 2.1 percent for Hyundai and 4.8 percent for Kia during the first three months of 2012 from a year before.

This starkly contrasts to major competitors, which were forced to slash the prices of their products due to the slump in the markets in the aftermath of the eurozone debt crisis and the economic downturn in the United States.

Professor Kim Pil-soo at Daelim College concurs.

“Hyundai Motor’s share prices have jumped of late. By contrast, those of Kia Motors still have great upside momentum, which would boost the overall value of Hyundai Motor Group,’’ he said.

“In particular, the debut of Kia’s premium sedan, the K9, will attract investors down the road. In case the share prices of Volkswagen do not jump, the chances are that Hyundai Motor Group will overtake it soon.’’

Kia Motors unveiled the much-touted K9 earlier this year, which the firm hopes will become a flagship model thereby boosting its brand image both at home and abroad.

It comes with a 3.3-liter or a 3.8-liter engine with prices ranging between 52.9 million and 86.4 million won including value-added taxes.

Kia Motors hopes to sell a total of 18,000 K9s this year with target figures projected to rise to 25,000 next year across global markets.

The company has invested around half a trillion won since 2008 to develop the real-wheel drive sedan with 300-plus horse power and a fuel efficiency higher than 10 kilometers per liter. <Korea Times/Kim Tae-gyu>