M&A frenzy

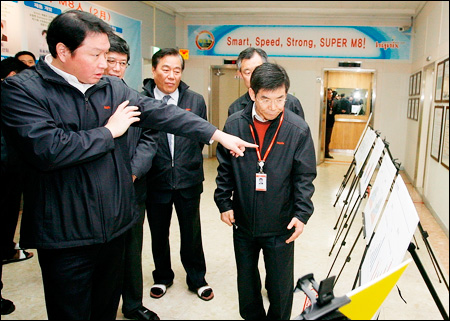

SK Group Chairman and SK hynix co-CEO Chey Tae-won, left, talks with executives during his recent visit to its NAND flash-making factory in Cheongju, North Choongcheong Province in this file photo. The company hopes its acquisition of U.S.-based chip controller maker LAMD to bolster SK hynix’s profile in the NAND flash memory business. / Korea Times file

SK hynix takes over US LAMD to bolster NAND flash business

SK hynix has been in the limelight in the global M&A market after taking over two foreign companies in the past month, a move seen as SK Group’s attempt to foster the chipmaker as its growth engine.

The bold move is in line with Chairman Chey Tae-won’s globalization drive under which the group is seeking to expand into U.S. and European markets. SK Telecom bought SK hynix, formerly Hynix Semiconductor, early this year.

Chey has opted for an inorganic growth strategy to bolster the chipmaker so that it can catch up with its rivals and emerge as the group’s main growth engine.

SK hynix said Wednesday that it bought a U.S.-based Link A Media Devices (LAMD) for 287 billion won. The deal allows it to completely acquire all patents owned by LAMD, which will become the company’s NAND-focused business unit.

Expectations are that the latest acquisition will help SK hynix expand its NAND flash business ― it had a 24.6 percent global share of conventional DRAM memory chips in the fourth quarter of last year, market research firm iSuppli said.

Last month, SK hynix acquired Italian NAND flash maker Ideaflash and has turned it into a research and development (R&D) center to boost the development of flash memory-related technology.

The series of acquisitions came as the company’s business for flash-type memory chips ― a component in almost all high-end digital devices such as tablets, cameras and smartphones ― was stalling.

The company is the fourth-largest player in the NAND chip market with a 12.6 percent share as of the end of last year after Samsung Electronics, Toshiba and Micron Technology, iSuppli said.

Officials said SK hynix is struggling to increase its NAND shipments to clients such as Apple as its manufacturing technology currently remains as a “second-tier’’ level, causing it to fail strict quality standards.

The latest deal with LAMD is a step in the right direction, given that SK hynix is the only NAND manufacturer that has failed to find a breakthrough in the market for solid-state drives (SSDs) ― the next-generation storage device that is replacing the bulky and conventional hard disk drives (HDDs).

SSD is based on very-fined NAND flash chip-making technology and Intel, Samsung, Toshiba, Micron Technology and even SanDisk are all big names in the market. One common thing with all of them is they have their own firmware.

SK hynix said the company can now guarantee a speedy supply of high-performance controllers made by LAMD. LAMD’s proven expertise could potentially help the firm improve battery life and storage capacity in high-end devices and also lower costs related to flash components.

“For SK hynix, securing in-house controllers is more important as it means higher profitability. The company secured a springboard to raise its market share in NAND flashes,’’ said Lee Seung-woo, an analyst at IBK Securities.

Officials say the latest acquisition is considered SK hynix’s answer to better respond to Apple’s purchase of Anobit ― an Israeli company that manufacturers digital signal processing technology to improve the performance of NAND flashes used in its i-branded devices.

“SK hynix also wanted to acquire Anobit. However, Apple did it. LAMD was our second option,’’ said a company executive familiar with the situation. <The Korea Times/Kim Yoo-chul>