Central bank preempts markets with rate cut

Bank of Korea Governor Kim Choong-soo speaks to reporters after the bank’s monetary policy committee decided to lower the country’s benchmark rate by 0.25 percentage points to 3 percent. / Korea Times photo by Lee Ho-jae

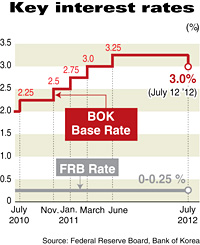

Quarter point slashed to 3% after no change in 13 months

The Bank of Korea (BOK) surprised markets by cutting interest rates Thursday as the country battles subduing economic activity and worsening global conditions.

The decision to shave the benchmark 7-day repo rate by 0.25 points to 3 percent, ended 13 consecutive months of maintaining it at 3.25 percent since February 2009, and was a clear-cut indicator that policymakers are once again putting growth before inflation.

This also doubled as their confession that the fate of Korea’s fragile recovery will hinge on the ability of households to take on even more debt when they already owe as much money as the entire economy generates in a year.

The triple fears of the debt problems in Europe, the faltering U.S. economy and a slowdown in China have Korea’s export industry panting on the ropes, but consumers have been unable to pick up the slack when family finances are decaying faster than last year’s milk.

Talking to reporters after the bank’s monetary policy meeting, BOK Governor Kim Choong-soo said the decision to lower borrowing costs wasn’t unanimous.

“We believe that the rate cut will help the economy return to the level of its projected long-term trends,’’ Kim said.

“The GDP gap was in positive figures last year, but expected to be in negative figures for some considerable time ahead, so there was a need for us to move preemptively and attempt to defuse the growing downside risks. Time will tell whether we have the room to lower borrowing costs.’’

The GDP gap refers to the difference between the economy’s actual and potential output, and is used as a measure of slack in the economy.

Incredulously, Kim claimed that the decision to cut the rate shouldn’t be interpreted as a change in BOK policy direction, this after prating ad nauseam in previous months that the bank was committed to returning rates to a normalized level of 4 to 5 percent.

“We can’t afford to stand still when the economic projections for the country continue to slide. The lower rate will help the real economy and lessen the burden on households in debt servicing,’’ Kim said. He anticipated the lowered borrowing cost will lead to a 0.5 percent increase in household lending but not more as the real-estate market continues to be in the doldrums.

The escalation of the European debt crisis has kicked Korean exports in the teeth and the sharp pullback in trade surplus has been raising expectations that the country’s gross domestic product (GDP) growth for the second quarter will retreat from the 0.9 percent quarter-on-quarter expansion in the first.

The Ministry of Strategy and Finance recently downgraded its growth forecast for the year from 3.7 percent to 3.3 percent, although predicting 4.3 percent growth for 2013. The BOK will announce its revised forecasts for this year and next today.

The BOK’s decision drew a cool reaction from markets, with the Korea Composite Stock Price Index (KOSPI) falling 2.24 percent to finish at 1,785.39 after Thursday’s trading, as the rate cut was seen just as much a strategy as an admittance that things are worse than feared.

“Considering domestic conditions, I think it’s hard to justify lowering rates. But I think the BOK responded to the series of rate cuts by the central banks in Europe, China and major developing nations,’’ said Lim No-jung, an economist from Solomon Investment and Securities.

“It’s positive that the BOK is sending a signal that the government is serious about injecting new energy into the economy. The move will affect bond markets more than the stock markets. However, the effect on household debt should be carefully monitored.’’

Critics said BOK is playing with fire by extending expectations for cheap borrowing costs, which they believe would allow personal indebtedness to get further out of hand.

The BOK had slashed the key rate by 3.25 percentage points to a record low of 2 percent between October 2008 and February 2009 to fight the global financial turmoil. The bank raised it by five steps between July 2010 and June 2011 to curb inflationary pressure.

“This is a dramatic reversal in stance by the BOK. Kim says it’s not, but who is he kidding. The lengthy talk about GDP gaps and subduing economic activity shows that growth is once again a priority over price stability and household debt, as exports continue to be wobbly,’’ said Oh Suk-tae, a senior economist at SC First Bank. <The Korea Times/Kim Tong-hyung>