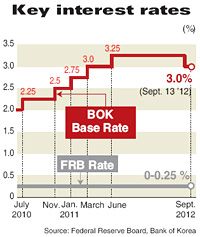

BOK freezes key rates at 3%

Bank of Korea (BOK) Governor Kim Choong-soo bangs a gavel at the central bank’s headquarters in Seoul, Thursday, after freezing the key interest rate at 3 percent. / Yonhap

Despite the recent gloomy economic news, the Bank of Korea’s (BOK) seven-member monetary policy committee kept key rates at 3 percent Thursday. However, market watchers feel that a further lowering of borrowing costs is coming sooner than later as the blizzard of bad data makes it difficult for policymakers to maintain a wait-and-see approach.

The bank’s interest-rate setters held the policy rate last month after shaving it by 0.25 percentage point in July, which came after a 12-month holding streak. Confidence in Korea’s trade-dependent economy has been eroding quickly as worsening global conditions kick exports in the teeth. Consumers can’t pick up the slack when stagnant wages, unemployment and historically high household debt have family finances in decay.

It’s now up to the government to keep growth alive and there had been expectations that the BOK would move to jolt money supply this month.

But with the finance ministry signing off a 5.9 trillion won (about $5.2 billion) stimulus to combat stagnant growth and further spending packages expected in the United States and Europe, the bank’s policymakers decided they could wait a little more before pulling the trigger.

“I know that the popular opinion in the market was that we would lower interest rates. However, the important thing is to consider what a certain move can do over a certain period of time. Whether the right time to make that move is today or tomorrow is dependent on how the members from the monetary policy committee see the state of the economy,’’ said BOK Governor Kim Choong-soo after the rate-setting meeting, adding that the decision to hold interest rates was unanimous.

“We did not hold the rates because of household debt. Generally, increased liquidity will lead to an increase in debt, but the situation in Korea is different because of the low savings rate in relation to income levels.”

He pointed out that lowering interest rates can help households by reducing the burden on interest payments and it could also have a positive effect on growth.

The subduing economic activity suggests that another downgrade to Korea’s growth estimates, which have been trimmed frequently in 2012, is inevitable. While the government’s most recent prediction in annual gross domestic product (GDP) growth is 3.3 percent, it now seems all but assured that growth will fall into the 2-somethings.

Exports declined by more than 6 percent in August from a year earlier, following a near-8 percent drop in July, and consumption figures continue to be lackluster. The household debt mountain is currently scaled at above 1 quadrillion won when the liabilities of families and self-employed businesses are taken into account, meaning that Koreans owe as much money as the country generates in a year.

In a statement released after the rate-setting meeting, the BOK’s monetary policy committee observed that the heady mix of negatives affecting the global economy will continue to test Korea’s economic mettle.

“Based on currently available information, the committee considers the economic recovery in the U.S. to have weakened somewhat and the sluggishness of economic activities in the eurozone to have deepened … The committee expects the pace of global economic recovery to be very modest going forward and judges the downside risks to growth to be large, owing chiefly to the spillover of the eurozone fiscal crisis to the real economy and to the possibility of the so-called fiscal cliff materializing in the U.S.,’’ it said.

“In Korea, the committee appraises economic growth to have been weak, as domestic demand has alternated between improving and worsening and exports have exhibited a downtrend.” <The Korea Times/Kim Tong-hyung>