A host of economic challengies agonize Syria

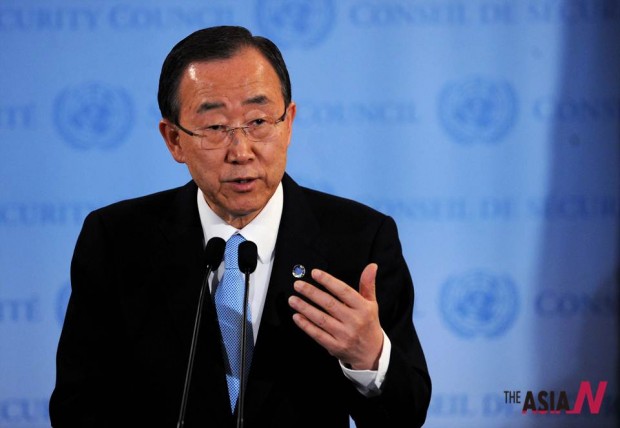

- UN Secretary-General Ban Ki-moon speaks to the media at the UN headquarters in New York, the United States, April 19, 2012. Ban said here Thursday that the situation in Syria remains highly precarious, and he looks forward to an early action by the UN Security Council on his proposed expansion of the UN ceasefire observation mission in the Middle East country. <Xinhua/Shen Hong>

DAMASCUS, May 13 (Xinhua) — While the Syrian government is working painstakingly to contain the consequences of sanctions imposed by the European Union and fill the shortage in basic items, the economic challenges it has countered before seem to be intractable and reappear over and over again.

In November, when Syrians lined in queues in front of gas distribution centers across the country, Syrian Oil Minister Sufian Allaw blamed the shortage on the EU sanctions imposed on the Syrian petroleum sector, as well as armed groups that had allegedly attacked freight trains transferring gas from the northwestern coastal town of Banias to the gas distribution station in the Damascus suburb of Adra.

The gas crisis was loosened for a while, but resurfaced recently.

The price of a cylinder of gas, which used to be sold at 350 Syrian pounds (less than 6 U.S. dollars) ahead of the crisis, is now 1,000 pounds — if the gas is available.

Allaw said in an interview with the official TV aired Sunday that the EU, which imposed in September an embargo on crude oil import from Syria and banned EU firms from new investment in the Syrian oil industry, “aims at pressuring the Syrian people and threatening their livelihood.”

Allaw said his ministry is working to supply the local market with gas and diesel soon through new contracts with other countries and exporters.

Iran is exerting considerable efforts to help to provide diesel and gas, with contracts having been signed for four consecutive monthly shipments, the first of which will arrive in early June, in addition to contracts with Venezuela, with a Venezuelan ship carrying diesel will arrive within a few days, the minister said, adding that Algeria was also contacted and responded positively.

Sending placatory signals, Allaw said despite the suspension of oil export from Syria, the Syrian government has spent 3 billion U. S. dollars to purchase petroleum products to meet the market’s needs, importing more than 2.2 million tons of diesel and around 500,000 tons of cooking gas since September 2011, adding that no ship carrying diesel or gas has reached Syria since April due to sanctions.

According to the minister, local gas production covers 60 percent of local requirements, while the rest rely on import.

The EU sanctions include an embargo on purchasing or transporting Syrian oil and prohibiting companies from dealing with Syria or investing in it, in addition to withdrawing experts and staff, suspending funding, and imposing sanctions on Syrian petroleum companies.

Among the precarious issues the Syrian government has lately addressed is the exchange rate of Syrian pound. The Central Bank of Syria has struggled to maintain the value of pound, which has precipitously declined shortly after the start of crisis in mid March, 2011.

The bank’s interference was influential in increasing the value of pound, which lost over 50 percent of value against dollar in the past few months. On Sunday, the exchange rate was 68 pounds against 1 dollar at the free market, from around 100 pounds to 1 dollar a month ago.

Sources at the Central Bank of Syria said the existing reserves of foreign exchange in the Syrian banking sector are excellent and huge, noting that the official reserves of hard currency have not been affected since the beginning of the crisis.

The sources also said that bank deposits, despite the fact of mass withdrawals at the beginning of the crisis, have dramatically increased as customers have become increasingly confident about the durability and stability of Syrian pound.

Financial expert Fadi Aljalilati said that the “high proportion of the current liquidity at the private banks in Syria is not a burden, but on the contrary is a safety valve for these banks during this phase.”

He said the liquidity reflects the country’s ability to encounter short-term commitments at due time.

Even though the exchange rate of Syrian pound has noticeably increased, prices of most of the consumer goods are still high.

As many products available at grocery stores are imported, their prices have steadily risen in recent months. One example is the Italian hazelnut-flavored Nutella chocolate, up 100 percent since September. Another is the canned Zwan meat, which now cost approximately 400 pounds each throughout Syria. One kilogram of Tomato is sold at 85 pounds, the highest price in decades.

The issue of high prices has added to the hardship of the Syrians and is still unresolved despite the government’s repeated confirmations that it would interfere to settle markets once again.

The EU is expected to ratify on Monday a new package of economic sanctions on Syria, which will probably include freezing the assets of individuals and companies that have allegedly supported the Syrian regime.

news@theasian.asia автокредит на подержанный автомобиль банки