Cash or card?

Tax evasion underlies preference of store owners

A few days ago, Kim Yoon-mi, a 25-year-old freelance translator, had an unpleasant moment at a small restaurant near her office in central Seoul.

She wanted to grab a quick bite before rushing to meet a client. Kim ordered two rolls of “gimbap” (rice rolled with dried sea weed and other ingredients) for 5,000 won and pulled out her credit card to pay, but the owner frowned at the sight of the card and simply said, “No.” He said they only take cash, so Kim ended up leaving without anything to eat.

Park Soo-jung, a 29-year-old college lecturer, also had an embarrassing experience a week ago. She went shopping to buy a dress for her sister’s birthday at a clothing store in the neighborhood.

She found a pretty black miniskirt with a price tag of 200,000 won. When she handed over her credit card, the clerk said the price of the skirt was 10 percent more if she wanted to use her card and demanded 220,000 won.

Taken aback, Park asked why she had to pay extra. The clerk said it is their policy as a way to offset the fee charged by credit card firms.

Park didn’t have that much cash, neither did she want to pay more than the actual price on the tag. “It was ridiculous. It felt like I was being ripped off,” she said.

In the end, she left the shop empty-handed. She couldn’t understand why she had to shoulder extra costs to pay by credit card.

Many mom-and-pop shops are reluctant to take plastic as the processing fees charged by card firms eat into their profits.

But the reluctance to accept cards inconveniences customers who nowadays don’t carry much cash.

Plus, credit card companies offer mileage and other benefits to customers to entice them into using their plastic more often to begin with.

On the other hand, merchants and shop owners know that refusing to take cards is illegal but some can ill-afford to pay card fees, especially while business is sluggish.

Fees suffocate store owners, or so they say

Lee, now in his 70s, has been running a small pharmacy in Jung-gu, central Seoul, for 34 years. The store, about 6.6 square meters in size, is located in a relatively remote corner of a street lined with office buildings, rather than a residential area.

Lee has witnessed many pharmacies in the district fold due to a lack of hospitals nearby and without being affiliated with hospitals, the lack of customers.

“Since we are not able to sell prescribed drugs, we don’t make a lot of money,” he said. “I myself may have to close my drugstore soon, as I am old and there are no prospects of this business improving.”

For Lee, customers paying with credit cards are a nuisance.

“There are some who hand me their card even when paying for a tiny box of band-aids, which cost only a couple of thousand won,” he said. “I wish the government would set a minimum for the amount people can pay with credit cards.”

The numbers of customers that prefer to use cards over cash is increasing.

“The fees charged by the credit card companies of course put us in a difficult position,” said Lee. “Another problem is that it is difficult to keep track of all the payments made by credit cards, as they belong to many different companies.

“I know that a change in the methods of payment is unavoidable. But I just want the government to help alleviate the burden on small shop owners like myself.”

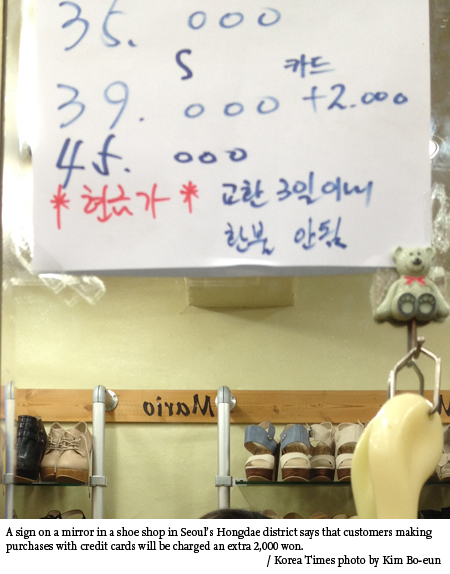

Other store owners are more explicit in their ways of coping with credit card fees. A shoe shop in the Hongdae district of Seoul has a sign indicating the different prices according to how a customer pays. The store charges an additional 2,000 for purchasing with a credit card.

Many other small businesses have opted for a similar strategy. They offer “discounts” or freebies for purchases made in cash.

The rate of commission charged by credit card companies for mom-and-pop stores is actually greater than that charged to larger retailers and department stores.

Even though the rates differ according to the type of business, an average of 3.5 percent is charged to the small shops, with the rates for large businesses from 1.5 to 2.4 percent.

This may not seem like much of a difference. However, small businesses are harder hit by slight differences than their counterparts since the scale of their sales is significantly smaller.

What’s behind the preference?

Although the ostensible reason for many business owners’ preference of cash-paying customers over card users is the fees they have to pay, the underlying truth actually lies somewhere else: tax evasion.

“What really takes a big portion of business owners’ revenue is tax. Although many of them claim that the high credit card fees are the reason they prefer cash, what they are really trying to do is to minimize their income tax by not reporting it,” said a 22-year-old sales assistant at a cosmetics shop in central Seoul. “Cash transactions make it possible for them to sweep the records under the rug so that they can pay less income tax. Some of them even openly offer discounts to customers who pay in cash.”

The cash discount is especially prevalent in areas where small-sized businesses are situated. In places like Dongdaemun Market it is even more serious since most are cash transactions.

Although many customers acknowledge the problem that the money they pay is most likely to go directly into the owners’ pockets without being recorded, they have no choice but to pay in cash to get the evidently better deal.

What’s really raising red flags is that these transactions are not transparent and therefore there is a high chance of dodging taxes. In other words, it only saves money for proprietors at the expense of the public.

“We do not even know the amount of tax evasion in the market. Even a rough estimation is hard to guess,” an official from the National Tax Service (NTS) said.

Despite this, results of the NTS’s recent investigations into tax evasion provide a glimpse of the massive scale of the problem.

Last year, the NTS found that 596 high-income business owners such as lawyers and doctors took home an additional 363 billion won in illegal gains by not reporting 37.5 percent of their total earnings.

According to the NTS, a dentist who specialized in chin surgery offered discounts to customers paying cash and hid 4 billion won in income in a borrowed-name bank account. Similar cases are numerous but due to limited resources it is realistically very difficult for the NTS to investigate all business owners. Consequently some people have spoken up on the need to improve the current taxation system, suggesting methods like imposing heavier punishments for tax offenders.

“The current taxation system is designed in a way that is unfair to office workers whose income records are relatively transparent. I’m not saying that the system is unjust. I believe everyone has to pay a fair amount of tax in consideration of their income,” said Chung, a 27-year-old businessman. “From a broader perspective, it undermines social justice.” <The Korea Times/Bahk Eun-ji, Kim Bo-eun, Jung Min-ho>