Chaebol exert bigger clout on bourse

Samsung Electronics, Hyundai Motor and Korea’s other top corporations have successfully taken advantage of the 2008 global financial crisis as a golden opportunity to emerge as a major player on the international stage.

Samsung is now the world’s largest smartphone maker, edging out Apple and other global technology giants, while Hyundai and its affiliate Kia Motor have become the fifth largest automaker ahead of Honda and other Japanese rivals.

No place better than the nation’s stock market reflects these and other success stories of Korea’s top businesses as their market caps have jumped sharply.

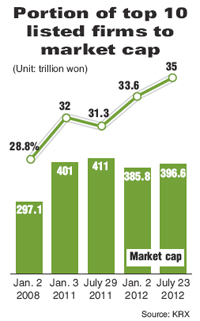

According to the Korea Exchange, Tuesday, the combined market capitalization of top 10 firms listed on the bourse reached 396.6 trillion won ($344 billion) as of July 23, accounting for 35 percent of the total market value.

The top 10 listed shares are Samsung Electronics, Hyundai Motor, POSCO, Kia Motors, Hyundai Mobis, LG Chem, Samsung Life Insurance, Samsung Electronics (preferred stocks), Hyundai Heavy Industries and Shinhan Financial.

Before the collapse of Lehman Brothers and the subsequent U.S. subprime mortgage meltdown in late 2008, the portion stood at only 28.8 percent on Jan. 2, 2008. But it has been heading upward steadily since the global financial crisis.

In January, the top 10 firms accounted for about 33.6 percent of the market cap, compared with 32 percent a year ago.

In particular, Samsung Electronics accounted for 15.1 percent of the market value Monday, up sharply from 7.78 percent on Jan. 2, 2008.

Foreigners’ active buying of shares of Korea’s top listed firms is largely attributed to the growing gap between large cap and small cap firms.

Non-Korean investors currently own a combined 49.19-percent stake in Samsung Electronics, while about 44.2 percent of Hyundai Motor and 50.2 percent of POSCO are held by foreign investors.

“Korea’s top listed companies exert greater influence over the stock market following the global financial market meltdown in late 2008 and the European debt crisis last summer,’’ said Kyobo Securities analyst Kim Hyung-ryoul said.

“This shows the country’s large business groups, most of which export industrial goods, have gained competitive edge over their foreign rivals despite a series of external downside risks over the past few years.’’

Kim said Samsung, Hyundai and other leading Korean companies have coped well with the global financial crisis and the subsequent economic downturn, adding they generated larger profits than their foreign competitors.

“The strengthened global competitiveness of large local firms has encouraged investors, particularly foreigners, to purchase their stocks, which naturally increased their market cap. But companies largely focusing on domestic market have not performed as well as export-oriented ones and seen their market cap either stagnate or decline,’’ the analyst said.

Hyundai Motor Group’s three flagship units ― Hyundai Motor, Kia Motors and Hyundai Mobis ― have made the greatest strive over the past few years, all entering the country’s top five listed companies.

Hyundai was 11th largest listed firm in early 2008. But now it is the second largest capitalized unit on the local bourse as it has emerged as one of the world’s top automakers.

Its sister carmaker Kia Motors and auto parts maker Hyundai Mobis have also boosted their market presence, with a growing number of investors betting on their future.

However, SK Telecom, the country’s largest wireless service provider, was the seventh largest market cap in 2008. But it now ranks 17th as its growth potential weakens in line with the increasingly saturated domestic telecommunication market.

Korea Electric Power Corp., which used to be the fourth largest listed company here, now ranks 14th as it incurred huge losses over the past few years. It has been forced by the government not to raise utility bills, despite higher oil prices and other rising costs.

With the prolonged sluggish domestic demand, Lotte Shopping and other retailers have also seen their market cap shrink over the years. In 2008, Lotte Shopping was 14th largest public company in 2008, but now ranks 27th. <The Korea Times/Lee Hyo-sik>