Economics of ramyeon

Instant noodle sales booming amid slump

It is obvious that businesses face a harder time selling their goods when the economy is bad as consumers tighten their purse strings. But ramyeon makers are an exception to this norm as people with lighter wallets tend to eat more instant noodles as a cheaper alternative.

Ramyeon producers have once again proved that they are immune from the ongoing economic downturn by selling more in the first six months of this year, compared with a year earlier.

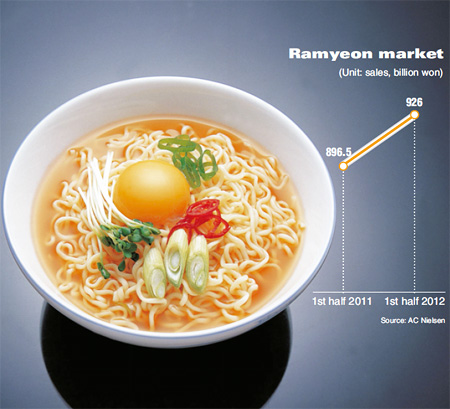

According to market researcher AC Nielsen, Wednesday, Nongshim, Samyang and other local instant noodle producers earned a combined revenue of 926 billion won in the first half, up 3.3 percent from 896.5 billion won in the same period last year.

The ramyeon market is widely expected to exceed 2 trillion won this year, up from 1.96 trillion won in 2011.

“Consumers tend to eat more instant noodles and other cheaper alternatives during the economic slump as they are forced to spend less on food and other daily necessities. Ramyeon makers sold 3 percent more in the first half,’’ a Nongshim spokesman said.

The consumer demand for instant noodles peaks in the summer holiday season from July to August, he said. “People also consume more ramyeon in November and December when the weather gets cold. So, we sell more in the latter half.’’

The spokesman projected that given the prolonged economic downturn and other factors, the entire ramyeon market will easily surpass 2 trillion won in 2012.

Companies also introduced 14 new products during the January to June period to capture larger market shares amid intensifying competition. In the first half of 2011, they unveiled only seven new items.

“We introduced Jinjja Jinjja and several other products in the first six months. So did our competitors. To expand our market presence, we will continue to develop new ramyeon for the remainder of the year,’’ the spokesman said.

Nonghshim’s market share stood at 64.9 percent in June, up from 63.3 percent a month earlier. Its market share has been on the up since January after falling to an all-time low of 59.5 percent in December last year.

The company was dealt a severe blow by its smaller rivals, including Paldo, which introduced a range of white-broth ramyeon.

The white-broth instant noodle fever chipped away at Nongshim’s market share in 2011. But the company has made a strong comeback this year with consumers increasingly turning away from white-soup instant noodles.

Sales of Kkokkomyeon by Paldo and other white-soup ramyeon have fallen sharply over the past few months, while Shin ramyeon manufactured by Nongshim and other red-broth noodles have flown off the shelves.

In 2011, Paldo introduced Kkokkomyeon, based on a chicken broth, kicking off a nationwide fad for white-soup ramyeon. But it faded fast and now the market trend favors the old paradigm that ramyeon has to be based on a red spicy soup.

Sales of three white-broth instant noodles_ Paldo’s Kkokkomyeon, Samyang’s Nagasaki Jjamppong and Ottogi’s Gismyeon _ accounted for only 4.4 percent of the market in June, down sharply from 17 percent in December. <The Korea Times/Lee Hyo-sik>