Trade reliance makes Korea vulnerable

The government’s efforts to expand domestic demand have failed, letting its dependence on exports and imports surge over the past years.

This may likely open the economy up to great shocks, if the current eurozone crisis gets worse and takes on global proportions.

Recent data from the Bank of Korea (BOK) show that the country’s over-reliance on trade has rather strengthened in recent months.

The country’s combined volume of exports and imports last year was measured at 113.2 percent of gross national income (GNI) to mark the highest level ever.

The ratio moved above 116 percent after the first quarter of this year as subduing economic activity, stagnant wages, unemployment and historically high household debt continue pull the rug from under domestic demand.

The ratio ranged between 70 percent and 80 percent during the early-to-mid 2000s before rising to above 110 percent in 2008, when the collapse of the Lehman Brothers threw the global economy into a spiral of turmoil. After inching down to 98.9 percent in 2009, it moved back up to 105.2 percent in 2010.

GNI, a commonly used indicator for a population’s purchasing power, measures total income generated domestically and brought in from abroad after deducting what foreigners earned here and remitted overseas.

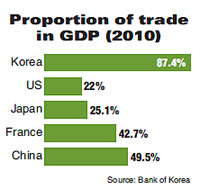

The proportion of trade to gross domestic product (GDP) reached 87.4 percent in 2010, significantly higher than the United States (22 percent), Japan (25.1 percent), France (42.7 percent) and China (49.5 percent).

“It’s plain as a pikestaff that an overreliance on world markets and trade increases volatility and makes it hard for the country to manage stabilized and sustained growth. We need to prepare long-term strategies to boost domestic demand and foster the underperforming service industry,’’ said Ju Won, an economist from the Hyundai Research Institute (HRI).

These certainly are critical times for the Korean economy: worsening global conditions are taking a bite out of exports, but consumers can’t pick up the slack when family finances are decaying. Exports dropped 8.8 percent year-on-year to $44.6 billion last month, according to the Ministry of Knowledge Economy Wednesday, marking the sharpest pullback in 33 months.

Retail sales declined 0.5 percent in June from the previous month as credit-crunched shoppers tightened their purse strings.

Output across the mining, manufacturing and services industries declined in June from the previous month as did business investment. Consumer price inflation has now dipped below 2 percent, triggering apocalyptic talk on whether the country is being sucked into deflation.

The blizzard of bad data forced Strategy and Finance Minister Bahk Jae-wan to admit recently that the GDP growth for the year could be in the range of 2 percent, strikingly lower that the government’s early-year prediction of 3.7 percent.

Since recovering from the late-1990s financial meltdown, Korea has had a succession of leaders in Kim Dae-jung, Roh Moo-hyun and Lee Myung-bak employing export-driven economic strategies. While this approach resulted in strengthened concentration of economic power to the biggest of corporations and wealthiest of people, policymakers had described inequality as inevitable and something that should be tolerated as the cost of national prosperity.

The strengthening argument now is that this polarization has hurt the country’s long-term growth potential and made it more vulnerable to financial downturns like the current one, where exports take a dip from worsening global conditions.

The massive gulf between the rich and the rest has taken the life out of consumption, severing an important recovery route for the economy as it attempts to navigate out of the current crisis. <The Korea Times/Kim Tong-hyung>