Egypt’s president ratifies budget for the new fiscal year

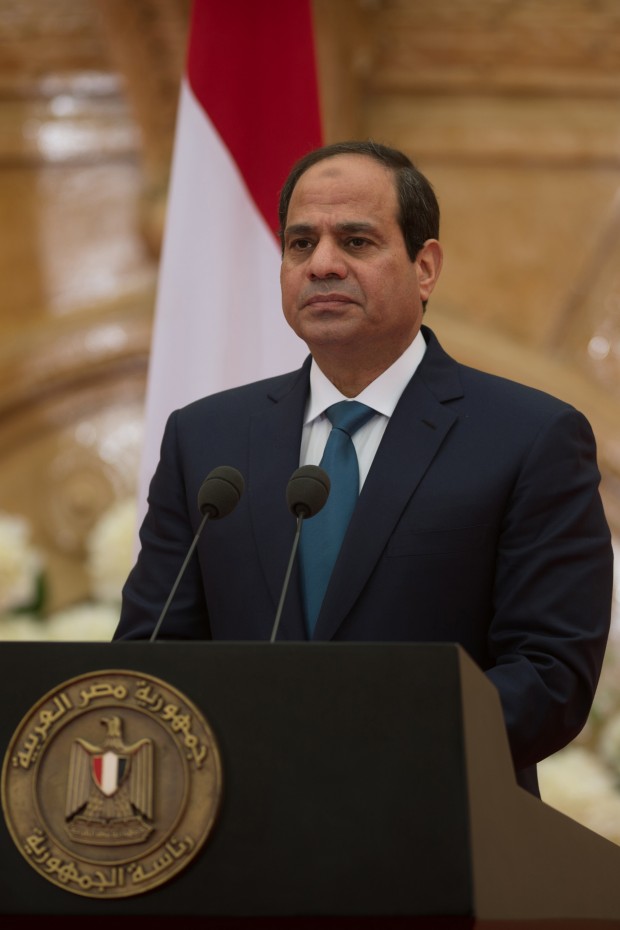

Egyptian President Abdel-Fattah al-Sisi delivers his speech at a joint press conference after his meeting with the visiting Russian President Vladimir Putin in Koba Palace, Cairo, Egypt. (Xinhua)

On Thursday 2nd July, Egypt’s President Abdel Fattah El-Sisi ratified the state budget for the fiscal year 2015/2016 following amendments by the Ministry of Finance to slash projected budget deficit, according to Egyptian state TV.

The cabinet approved just a day before the draft budget for the 2015/2016 fiscal year, to reduce projected deficit to 8.9 percent of GDP, according to a statement issued by the ministry.

An earlier draft that put the budget deficit at 9.9 percent had been rejected by El-Sisi, on grounds that it was too high, according to media reports.

And according to Al-Ahram newspaper, one of Egypt’s local newspapers, the new state budget projects public expenditure to rise by 17 percent from the previous year to LE868 billion ($112.3 billion), while revenues are expected to reach LE622 billion ($80.5 billion), a 28 percent increase on 2014/2015.

“Tax revenues will account for LE422 billion ($54.6 billion), while grants are estimated at LE2.2 billion ($285 million), compared to LE25.7 billion ($3.4 billion) in the previous fiscal year.

Fuel subsidies were set at LE61.7 billion ($8 billion) on an estimated price for Brent at $70 per barrel, while electricity subsidies were set at LE31.1 billion ($4 billion), according to the budget statement published on the ministry of finance website.

Expenditure on servicing Egypt’s public debt will increase by a quarter to LE244 billion ($31.6 billion). Government investments will rise by 25 percent to LE55 billion ($7.1 billion).

Egypt has set a five-year macroeconomic plan that aims to cut the state budget deficit to 8 to 8.5 percent by 2018/2019, by reforming state subsidies and introducing new taxes.”