Gross margin ratio definition

Contents:

If a company sells its products at a premium, with all other things equal, it has a higher gross margin. But this can be a delicate balancing act because if a company sets its prices overly high, fewer customers may buy the product, and the company may consequently hemorrhage market share. If a company’s gross profit margin wildly fluctuates, this may signal poor management practices and/or inferior products.

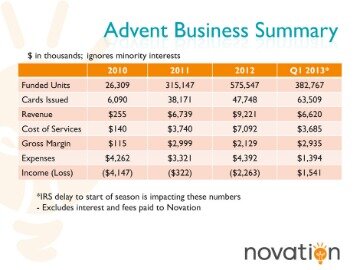

Terms such as net profit margin,net profit formula, cost-of-goods-sold, or gross profit margin are just numbers. Reading a financial statement is at the bottom of your “To-Do List.” You’ve wondered what the numbers have to do with running a subscription service. Consider the gross margin ratio for McDonald’s at the end of 2016 was 41.4%.

What Is the Difference Between Gross Sales and Profit Margins?

Gross profit is the sum total of all income earned in a given year for an individual or a company. In other words, the company is becoming more efficient and generating more profits for the same amount of labor and material cost. Percent of markup is 100 times the price difference divided by the cost. Opening StockOpening Stock is the initial quantity of goods held by an organization during the start of any financial year or accounting period. It is equal to the previous accounting period’s closing stock, valued in accordance with appropriate accounting standards based on the nature of the business.

According to IBIS World data, some of the industries with the highest profit margins include software developers, industrial banks, and commercial leasing operations. A high profit margin is one that outperforms the average for its industry. According to CFO Hub, retailers’ average gross profit margin is 24.27%. Let us discuss some simple to advanced models of the sales gross margin formula to understand the concept better. Gross profit is the monetary value that results from subtracting cost-of-goods-sold from net sales. It divides the gross profit by net sales and multiplies the result by 100.

However, increasing the price of goods should be done competitively so that it does not become too expensive. A gross margin ratio is an economic term that describes how much profit a business makes per revenue generated. It is a ratio that gives a snapshot of how efficiently a company is making a profit from its raw materials. For a soap company, a unit may be a roll of soap, while for a bottled drink company, a unit might be a crate. The unit margin is defined as the difference between the selling price per unit and the cost per unit of production.

Here, the gross profit is the returns acquired after considering the cost of goods sold, trade discounts and sales returns for deduction from the total revenue. The main constituents of the gross margin ratio are the operating revenue and expenses. These two heads are vital to the business and help the management to oversee the performance of the production and sales division.

Global Leak Detection Dyes Market [2023-2030] The Future of … – Digital Journal

Global Leak Detection Dyes Market [2023-2030] The Future of ….

Posted: Fri, 21 Apr 2023 09:19:09 GMT [source]

The gross margin shows how efficiently a company is making a profit from its raw materials. A high gross margin ratio means that a company is efficiently changing raw materials to finished products for profit. Companies and businesses always target a higher gross margin ratio. We have calculated the gross margin ratio to be 70% while the unit margin is $7. From the gross margin, it means that 70% of revenue is profit for the company. From the unit margin, it means that for each unit of soap the company sold at $10, the company made a profit of $7.

Outsourcing to a professional team that provided management accounting is essential to your business’s success and growth. Gross profit margin is a metric analysts use to assess a company’s financial health by calculating the amount of money left over from product sales after subtracting the cost of goods sold . Sometimes referred to as the gross margin ratio, gross profit margin is frequently expressed as a percentage of sales.

Company

Joe thinks he may be able to cut back on raw materials by changing his construction process. Essentially, he is wondering what is his gross profit margin rate is. Once the proper numbers are found uses the gross profit margin ratio calculator on his Texas Instruments BA II. His results are shown below. Gross profit margin is a metric used by companies to measure how efficiently they are converting revenue into profit. It is calculated by dividing gross profit by revenue and expressed as a percentage. Gross profit is the difference between revenue and the cost of goods sold.

Again, gross margin is just the direct percentage of profit in the sale price. Gross margin can be expressed as a percentage or in total financial terms. If the latter, it can be reported on a per-unit basis or on a per-period basis for a business. Since it reveals the amount of profit made by a company after calculating the cost of products sold, it helps to reveal its financial strength and status. It also helps companies to make financial projections and future plans.

Medical Practice Management (PMS) Market Top Innovator analysis … – Digital Journal

Medical Practice Management (PMS) Market Top Innovator analysis ….

Posted: Fri, 21 Apr 2023 09:19:09 GMT [source]

In the above case, Apple Inc. has reached a gross margin of $98,392 and 38% in percentage form. This 38% gross margin indicates that out of $1 of revenue from net sales, Apple Inc. can make a gross profit of 0.38 cents. Both gross margin formulas are used depending on what metrics are being evaluated. Gross margin refers to the percentage value while gross profit may be used to indicate the dollar value. Once deducted, the gross margin percentage can be computed by dividing gross profit by the amount of revenue generated in the corresponding period.

There are three other types of profit margins that are helpful when evaluating a business. The gross profit margin, net profit margin, and operating profit margin. Retailers can measure their profit by using two basic methods, namely markup and margin, both of which describe gross profit.

Gross Margin Value Calculator

It looks at how much the company makes per $1 of revenue generated. Or, to put it another way, a profit margin shows how much revenue a company can keep as profit. For example, a 60% profit margin would mean a company had a profit of $0.60 for every dollar of revenue generated. Gross profit is a currency amount, while margin is a ratio or percentage. Gross profit margin is the percentage left as gross profit after subtracting the cost of revenue from the total revenue. The formula compares the gross profit with the net sales or revenue of the company.

The ratio for the Bank of America Corporation at the end of 2016 was 97.8%. Comparing these two ratios will not provide any meaningful insight into how profitable McDonalds or the Bank of America Corporation is. But if we compare the ratios between McDonald’s and Wendy’s (two companies operating in the fast-food industry), then we can get an idea of which company enjoys the most cost-efficient production. For example, a legal service company reports a high gross margin ratio because it operates in a service industry with low production costs. In contrast, the ratio will be lower for a car manufacturing company because of high production costs. Comparing gross profit margins with competitors can help you figure out how much of your costs you can pass on to customers before they begin looking elsewhere.

There is a wide variety of profitability metrics that analysts and investors use to evaluate companies. This means that for every dollar generated, $0.3826 would go into the cost of goods sold, while the remaining $0.6174 could be used to pay back expenses, taxes, etc. Collectively, however, you can look at all three margins to determine your business’ overall outlook. Service companies, such as law firms, can use the cost of revenue instead of the cost of goods sold . You can adjust the equation to reflect different individual components of your business, to provide an overall picture, or to be reflected as a percentage or ratio.

I also have a Ph.D. in English and have written more than 4,000 what does mm mean for regional and national publications. We’ll start by listing out the revenue and cost of goods sold assumptions for each company. Andrew Bloomenthal has 20+ years of editorial experience as a financial journalist and as a financial services marketing writer. However, this must be done competitively – otherwise, the goods would be too expensive and fewer customers would purchase from the company. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles.

What is Gross Margin?

Profit margin varies by industry, so a good profit margin in one company may be very low or very high, compared to a different company. In general, though, a 10% profit margin is strong, but a 5% profit margin is low. The GPM can be used to compare the profitability of two or more companies.

- In other words, each product the company makes generates a revenue of $0.75 from every dollar.

- Investors look at gross margin percentages to compare the profitability of companies from different market segments or industries.

- Accrual Method Of AccountingAccrual Accounting is an accounting method that instantly records revenues & expenditures after a transaction occurs, irrespective of when the payment is received or made.

- If companies can get a large purchase discount when they purchase inventory or find a less expensive supplier, their ratio will become higher because the cost of goods sold will be lower.

- A company could post incredible gross profit margins but see most of those percentage points whittled away by remaining operational expenses.

As sales volume increases, the fixed cost component is fully covered, leaving more sales to flow through as profit. Thus, the gross margin ratio is more likely to be low when sales volume is low, and increases as a proportion of sales as the unit volume increases. This effect is less evident when the fixed cost component is quite low. Generally speaking, service industries that do not sell physical products will post higher gross profit margins because they have a much lower COGS. The gross profit margin is a calculation used to measure a company’s financial performance. It is calculated by dividing the company’s gross profit by its net sales.

How To Calculate?

If not managed properly, these indirect costs can really eat into a company’s profit. Most small businesses start as “flying by the seat of your pants” operations, with little use of data for decision making. As the business grows, however, it becomes essential to introduce ways of measuring and assessing various aspects of the business to ensure growth and profitability.

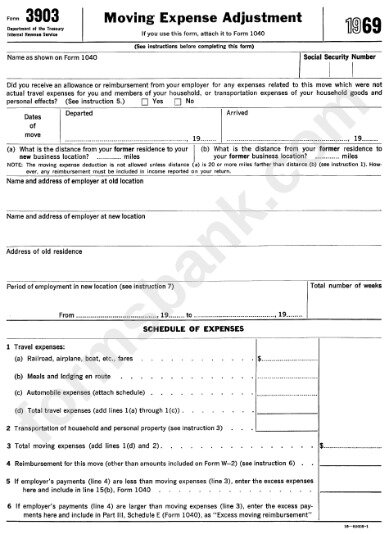

For example, you can mention if your relative has a small business and you helped them look at their profit margins to find areas where cutting costs would have a big impact. To determine the net profit margin, we need to divide the net income by the total revenue for the year and then multiply by 100. No, they are not always equal as gross profit is an absolute value in dollars while gross margin is expressed as a percentage. The best ways to increase gross margin are to raise prices or reduce the cost of producing the goods or services. Percent of gross margin is 100 times the price difference divided by the selling price. Some retailers use margins because profits are easily calculated from the total of sales.

How to Calculate Profit Margins: Definition and Examples

It is important to specify which method is used when referring to a retailer’s profit as a percentage. Higher gross margins for a manufacturer indicate greater efficiency in turning raw materials into income. For a retailer it would be the difference between its markup and the wholesale price.

Using this equation, you can create a Contribution Margin Income Statement, which reverses the order of subtracting fixed and variable costs to clearly list the contribution margin. Gross margin ratio measures the profitability of products — how much income each product generates after paying for its cost. Gross margin is the percentage of profits an organization is able to retain after all deducting all direct expenses relating to production. To understand the sales gross margin formula, it is important to understand a few other concepts around it such as gross sales, cost of goods sold, and net sales. To calculate the gross profit margin percentage, divide gross profits by total revenue. Evaluating gross profit margin is difficult because every business is unique.

In accounting, the gross margin refers to sales minus cost of goods sold. It is not necessarily profit as other expenses such as sales, administrative, and financial costs must be deducted. And it means companies are reducing their cost of production or passing their cost to customers. The higher the ratio, all other things being equal, the better for the retailer. Profitability Of The CompanyProfitability refers to a company’s ability to generate revenue and maximize profit above its expenditure and operational costs. It is measured using specific ratios such as gross profit margin, EBITDA, and net profit margin.

- Despite the differences in operating expenses , interest expenses, and tax rates among these companies, none of these differences are captured in the gross margin.

- The fact that net income is “levered” (i.e. post-debt) and flows solely to equity holders is one of the primary drawbacks to the net margin metric.

- To understand the sales gross margin formula, it is important to understand a few other concepts around it such as gross sales, cost of goods sold, and net sales.

- So, it turns out to be one of the primary factors to be checked when a better player from the same industry needs to be picked.

- To determine the net profit margin, we need to divide the net income by the total revenue for the year and then multiply by 100.

- Companies within this sector should betracking KPIsto compensate for the current uptick in sales.

If you have visibility into what causes profits, you can add fields based on the decisions you need to make to drive more profits. The relationship between revenue and the cost to generate that revenue. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.