Singapore magnet for K-food business

People walk through Singapore’s major shopping town Orchard Road. Many Korean food companies use Singapore as a test bed for their expansion into Southeast Asian countries. / Courtesy of Singapore Tourism Board

All roads lead to Singapore. This is a maxim for many Korean food companies seeking successful overseas expansion.

The country’s two leading bakery brands — CJ Foodville and SPC — have opened flagship stores in the city-state, testing their strength before moving on to its neighbors that include China, Vietnam, Cambodia, the Philippines and Indonesia. Major beverage brand Smoothie King will open its first store in the city by the end of the year.

Among other companies selecting Singapore as a test bed for overseas expansion are fried chicken maker BBQ, family restaurant chain Mad for Garlic, hand-made hamburger chain Kraze Burger, organic ice cream and yogurt maker Red Mango, and Korean food restaurant Nolboo.

Analysts say food companies in other countries also eye Singapore as a test bed for their Asian expansion, and this preference is one of the major factors keeping the country’s inward foreign direct investment (FDI) increasing despite the protracted global economic slowdown. Singapore’s incoming FDI stood at $38.6 billion in 2010, up from $15.3 billion in 2009, according to the latest data from Statistics Singapore.

“Singapore is a melting pot in Asia,” said senior analyst Baek Woon-mook of Daewoo Securities, referring to a socio-cultural term coined by U.S. President Woodrow Wilson to describe diversity within the United States in terms of culture, race, state of origin and other backgrounds in one community. “Though the size of Singapore is small, the country is a mixture of starkly different lifestyles and eating habits among others, which means a successful performer in the Singapore market is proven to appeal to customers in many other Asian countries.”

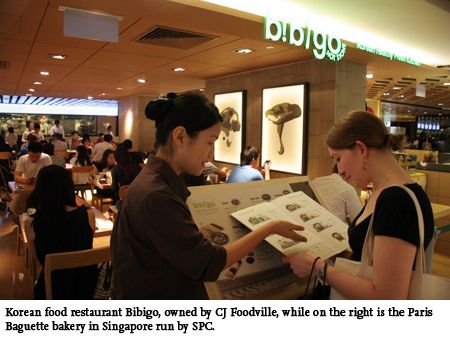

CJ Foodville, a bakery and family restaurant arm of CJ Group, runs one Tom N Toms coffee shop and three Korea food restaurants, called Bibigo, specializing in the signature Korean dish, bibimbap (a bowl of steamed rice topped with vegetables, beef, a whole egg, and Korean chili pepper paste).

“Singapore is the ideal test bed for food companies seeking overseas expansion,” said Kim Moo-jong, CJ spokesman. “If we successfully take root in the Singapore market, I think the likelihood of CJ having a smooth entrance into neighboring counties will be very high.”

The spokesman said that average sales at CJ’s stores in Singapore were far higher than those of its stores in Korea. He added that the company will take advantage of lessons from Singapore to open 10,000 stores worldwide by 2017, aiming for 5 trillion won ($4.47 billion) in sales and 310 billion won in operating profit by the target year. In the latest drive, CJ formed a partnership with China’s biggest real-estate developer SOHO China last month, giving the firm the priority for space in buildings or shopping malls owned by the developer.

CJ’s archrival SPC is also aggressive in the Singapore market. It’s testing the market feasibility of a flagship store with the goal of establishing 20 more outlets by 2020. The firm currently has 124 overseas stores — 100 in China, 21 in the U.S., two in Vietnam and one in Singapore.

In the long run, SPC spokesman Park Kyung-bae said, the company will open 1,000 stores in 20 counties by 2015 and 3,000 stores in 60 nations by 2020.

The Singapore store posts 12-13 million won in daily sales, nearly six times higher than that of the average sales of 3,000 stores in Korea, Park said.

“We are engaging in fierce competition with international bakery brands there,” Park said, pointing to Singapore-based Bread Talk and Deli France; France-based Paul and Maison Kayser; and American brand Dean & Deluca. “We are approaching the market with a premium strategy targeting high-end customers. If we survive and keep flourishing in Singapore, this indicates we have proven ability to make money in such emerging markets as China and the Middle East.”

Beverage brand Smoothie King, an American company taken over by its Korean affiliate in July, plans to open its first Singapore store in December.

“We will take Singapore as a stepping stone toward other Southeast Asian countries,” said Kim Sung-wan, CEO of Smoothie King. “In five years, I will build up the firm’s reputation as the world’s leading beverage brand with 1 trillion won in sales and a 20 percent operating profit.”

Smoothie King plans to open 351 stores in Korea, 1,500 in the U.S., 35 in Singapore, and 200 in China within that timeframe. Kim said a good performance in Singapore will make it easier for the company to tap into other markets such as China, Japan, Thailand and Malaysia. “If our performance is good, we will face increasing pressure to branch out into other Asian nations,” he said.

Many analysts point to India as the next preferred test bed for Asian expansion. Daewoo Securities analysts Baek said India is still a less attractive destination for flagship stores due to the weak buying power of its people, but its closeness to the Middle East is a strong indicator that India will become “the next big thing.”

Korea’s retail giant Lotte took over a local confectionary company in 2004, testing the profitability of the Indian market. <The Korea Times/Park Si-soo>